We Install Solar, Air Conditioning

& Electric Systems

Professional Services

Project & Portfolio

Project Showcase

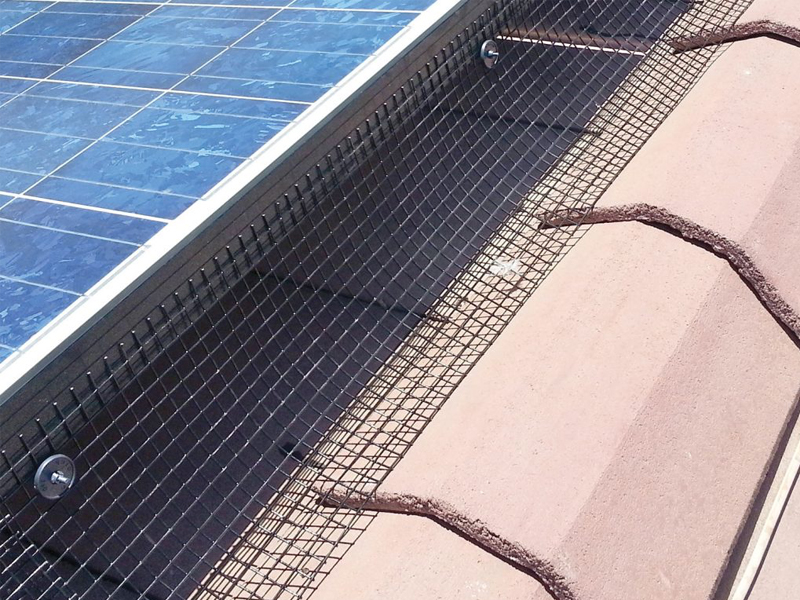

Project : Destiny Enterprises Co., Ltd.

Description : 60 Kilowatt On Grid Solar Installation

TREND & NEW TECHNOLOGY

Recommend

Alpha Ess Smile T10-HV

Residential Hybrid Energy Storage System (ESS) is a new kind of power solution.

Hybrid inverter

- Max. PV input: 16 kWp (2x MPPT / 4 strings)

- Nominal output: 10 kW AC

- Rated voltage: 380 V / 400 V

- UPS <15ms

- BMS & EMS integrated

- An integrated cable box with PV and battery isolator

- Product warranty: 5 years

Battery Module

This outstanding LFP (LiFePO4) high voltage battery is ONLY sold together with the Alpha Smile T10-HV Inverter as a set or for Smile T10-HV owners who want to expand their system!

- Capacity: 8.2 kWh (DOD 95%) 256 V

- Performance warranty: 10 years

- Product warranty: 5 years

- 6 Max. modules in parallel

Eyekandi Solar

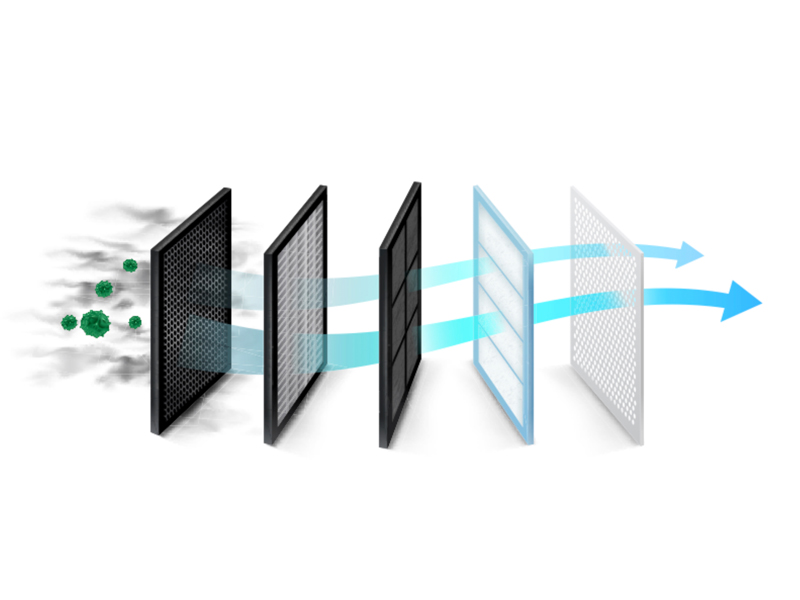

specializes in installs/replacements of Air-Conditioning systems in Chiang Mai. We service homes, businesses, schools, and hotels in Chiang Mai. Whether or not you are interested in a solar installation, we can install air conditioning for you.

We have fully licensed Air-Conditioning technicians with over 20 years of experience. Not only in Thailand but in the United States and Australia. At Eyekandi Solar we pride ourselves on customer service. Not one of our competitors offer the same level of integrity and attention to your needs. We will work with you to arrange a convenient date and time frame for your service call or estimate request.

Eyekandi Solar

Solar water heaters are a cost-effective way to generate hot water for your home. They can be used in any climate, and the fuel they use is --sunshine-- is free!

Eyekandi Solar

provides custom solutions for new homes, condominiums, schools, hotels and factories and electrical engineering services of all kinds. We operate from our base in Chiang Mai, Thailand and our team works throughout the region and the country.

Whatever the job you need, whether it’s starting from scratch or working on an existing site, EyeKandi Electrical will consult, plan and produce an electrical system that best suits your needs. From initial bids to final inspections you know you’ll be receiving the best service with top products from EyeKandi Electrical.

Survey Booking

Contact to Our Team

Address

18.74251088628696, 99.0083442496613

Nong Phueng

Saraphi District, Chiang Mai 50140

Call Me Now

(+66) 061 529 6226